Development Contributions for Local Infrastructure

(Back to top)City of Parramatta Council collects development contributions under a range of plans to fund infrastructure for the community including parks, libraries, traffic and transport infrastructure. The funding of local infrastructure is assisted in part by developer contributions known as Section 7.11 or Section 7.12 contributions.

Contribution Plans

(Back to top)Council has two (2) contribution plans currently in effect one applies to land within the Parramatta CBD. The other applies to the rest of the LGA. A map showing the application of each plan is provided here.

-

The Parramatta City Centre Local Infrastructure Contributions Plan 2022 applies to land within the Parramatta City Centre and repeals Parramatta CBD Development Contribution Plan 2007 (Amendment 5). The Plan applies to all applications lodged from 14 October 2022 as outlined in the public notice.

On 13 December 2024, the Parramatta City Centre Local Infrastructure Contributions Plan 2022 (Amendment No.3) came into effect. The revised plan introduces a change in the rate, applying 4% for developments that include residential accommodation and 3% for all other types of development within the Church Street North Precinct.

For more details regarding the amendments refer to Council's Business Paper of 27 May 2024.

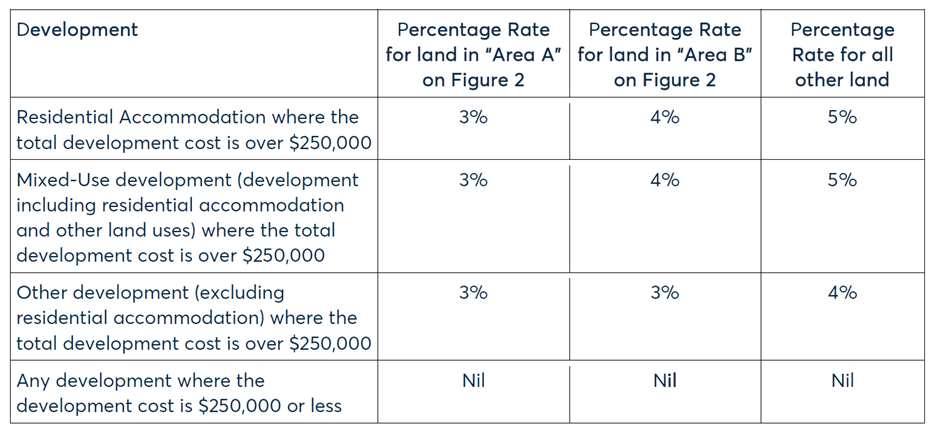

This Plan applies to development that needs consent and that has a cost of works of $250,000 or more. The contribution fee is levied as outlined in the table below.

Refer to Map to determine relevant area

The development cost must be calculated by a suitably qualified person as part of a DA or CDC application. A Cost Summary Report is required for application with a development cost over $200,000 up to $3 million.

Where the cost of the development exceeds $3 million, a Quantity Surveyors Report is required to be prepared in accordance with Section 208 of the Environmental Planning & Assessment Regulation 2021.

Superseded Versions

- Original Version (effective date 14 October 2022) replaced by Amendment 1

- Parramatta City Centre Local Infrastructure Contributions Plan 2022 (Amendment No.1) (effective date 30 June 2023) replaced by Amendment 2. For more details regarding the amendments refer to Council’s Business Paper of 22 May 2023 and the related public notice.

- Parramatta City Centre Local Infrastructure Contributions Plan 2022 (Amendment No.2) (effective date 29 April 2024) replaced by Amendment 3. For more details regarding the amendments refer to Council’s Business Paper of 27 May 2024 and the related public notice.

-

On 20 September 2021, the City of Parramatta (Outside CBD) Development Contributions Plan 2021 originally came into effect and applies to all land within the City of Parramatta LGA excluding the Parramatta CBD and Sydney Olympic Park Authority.

On 9 May 2023 the City of Parramatta (Outside CBD) Development Contributions Plan 2021 – Amendment No.1 came into effect. The amended Plan continues to apply to the same land area as identified above. For more details regarding the amendments refer to Council’s Business Paper of 11 April 2023.

The latest rates sheet can be found here

This plan calculates contributions fees on the net increase of new residents, workers and visitors of for various types of development uses in the Parramatta Local Government Area. Some exceptions payment of development contributions are included in Part 1.3 of this plan.

This Contributions Plan replaces eight (8) former contribution plans which used to apply to this area. More details on the former plans is listed under the heading 'Former Contribution Plans'

Superseded Versions

Original Version (effective date 20 September 2021) replaced by Amendment No.1

-

There are numerous former contributions plans that Council continues to collect development contributions from in accordance with historic DA or CDC applications.

The former Development Contributions Plans map shows which development contributions plan applied to land within the City of Parramatta LGA prior to 20 September 2021. These include:

- Auburn Development Contributions Plan 2007 Amendment No 1

- Carter Street Precinct Development Contributions Plan 2016

- Holroyd Section 94 Plan 2013

- City of Parramatta S94 Development Contributions Plan (formerly Hornsby LGA Land and Epping Town Centre)

- City of Parramatta S94A Development Contributions Plan (formerly Hornsby LGA Land and Epping Town Centre)

- City of Parramatta Section 94A Development Contribution Plan (Former Hills LGA Land)

- Contributions Plan 14 - Carlingford Precinct

- Parramatta Section 94A Development Contribution Plan (Amendment No. 5)

- Parramatta CBD Contributions Plan (Amendment No.5)

- Parramatta City Council Section 94 Contributions Plan No.1 for Parramatta City Centre - (Traffic)

For more information on previous plans, visit one of the links above and your development consent to consider whether these former contributions plans are relevant for you.

-

Contribution fees are put towards funding development-generated demand for local infrastructure within the Parramatta Local Government Area. These fees fund infrastructure works such as open space/outdoor recreation, indoor sports courts, community facilities, aquatic facilities, traffic & transport, and plan administration to meet the needs of the existing and future population. More details on these types of contributions are shown in the Works Program Appendices of each Contribution Plan.

-

The Development Contributions Plan map shows where each development contributions plan applies.

-

A Development Application or Complying Development Certificate often requires a payment of a contribution fee. Requirements for development contributions fee payment are shown within a condition of consent.

Accredited certifiers are responsible for ensuring that a condition is imposed on a complying development certificate per the relevant Contributions Plan. They must notify the Council of their determination within two (2) days of making the determination, in accordance with the Environmental Planning and Assessment Regulation 2021. Applicants must pay their contribution before commencing the complying development works.

-

Yes. These are listed in the plan relevant to that area and development category. If your development is exempt from development contributions, this is stated in the Development Application (DA) or Complying Development Certificate (CDC) assessment.

Exclusions From Development Cost for S7.12 Contributions Levy Assessment

Section 208(4) of the Environmental Planning and Assessment Regulation 20211 (“the Regulation”) states that the following costs and expenses must not be included in an estimate or determination of the proposed cost for the determination of S7.12 levies:

(a) the cost of the land on which the development will be carried out,

(b) the costs of repairs to a building or works on the land that will be kept in connection with the development,

(c) the costs associated with marketing or financing the development, including interest on loans,

(d) the costs associated with legal work carried out, or to be carried out, in connection with the development,

(e) project management costs associated with the development,

(f) the cost of building insurance for the development,

(g) the costs of fittings and furnishings, including refitting or refurbishing, associated with the development, except if the development involves an enlargement, expansion or intensification of a current use of land,

(h) the costs of commercial stock inventory,

(i) the taxes, levies or charges, excluding GST, paid or payable in connection with the development by or under a law,

(j) the costs of enabling access by people with disability to the development,

(k) the costs of energy and water efficiency measures associated with the development,

(l) the costs of development that is provided as affordable housing,

(m) the costs of development that is the adaptive reuse of a heritage item.When preparing a cost summary report, the Council requires applicants to provide cost estimates of certain items they are seeking to exclude from the development cost, along with evidence in relation to the proposed exclusion.

Exclusion of Fittings and Furnishings

Under Section 208(4)(g) of the EPA Regulation, the cost of "fittings and furnishings" can be excluded from the development cost. However, this exclusion is not applicable if the 'fit out' results in an enlargement, expansion, or intensification of the current use of land.

Required Evidence

Applicants must provide evidence confirming that the proposed development will not lead to an enlargement, expansion, or intensification of the current land use. The evidence may include:

• Existing and proposed floor plans

• Information on existing and proposed hours of operation

• Information on existing and proposed worker/visitor/patron numbers or venue capacityIf insufficient evidence is provided, the Council reserves the right to include the item in the development cost calculation.

Definitions

Although the Environmental Planning and Assessment Act or Regulation does not explicitly define "fixtures," "fittings," or "furnishings," a legal distinction exists between these terms.

"fixtures" are distinct from "fittings" and "furnishings" and cannot be excluded from the cost calculation under this provision.

Fittings and Furnishings

Fittings and furnishings are items that can be removed from a property without causing damage. Examples include:

• Blinds

• Curtains

• Luminaires

• Temporary Internal partitions (not affixed to the walls)

• Doors to internal partitions (if the partitions are considered fittings)The Council interprets "refitting and refurbishing" as relating specifically to "fittings and furnishings."

Fixtures

Fixtures are items permanently attached to a building and cannot be removed without causing damage. They typically remain upon a change in occupancy. Examples include:

• Ambulant toilets upgrade and unisex accessible toilet installations or upgrade

• Bath

• Water closets

• Built-in cupboards

• Joinery attached to the wall by nails

• Communication/security services installations or upgrade

• Automatic smoke detection and alarm system installations or upgrade

• Drop ceilings

• Electrical services for ceilings

• Fire services installations or upgrade (excluding portable extinguishers)

• Hydraulic services installations or upgrade

• Mechanical services installations or upgrade

• Kitchen and utilities

• Walls and wall finishes (e.g., painting)

• Floor finishes (e.g., carpeting and tiles)

• Ceiling finishes (including drop ceilings)Note: This list is not exhaustive.

Conclusion

Applicants are reminded to submit comprehensive evidence to support their exclusion claims. Failing to do so may result in the Council including the item in the development cost.

-

Contributions rates and outstanding feeds are indexed by Council on a quarterly basis in accordance with the All Groups (Sydney) Consumer Price Index (CPI) released by the Australia Bureau of Statistics (ABS) every 3 months. The CPI releases dates by the ABS generally occur in late January, late April, late July and late October each year. For more information on CPI refer to the ABS website.

-

Please visit Live Contributions Fees Register to confirm the amount payable prior to making payment, as contributions are subject to indexation. Please note that the contribution amounts displayed in Live Contribution Fees Register are typically accurate only on the day searched and may be subject to further indexation in accordance with movements in the consumer price index.

Your development consent outlines when to pay contributions. This is usually before the issue of a Construction Certificate or Subdivision Certificate (whichever comes first) or before any work commences for a Complying Development Certificate.

To pay, please go to Council’s website and select Online Services > Make a Payment > Applications Payment and include your current payment amount and application number for your DA or CDC.

Once paid, the funds are held in Council’s financial reserves for use on projects listed within the Works Program of each Development Contributions plan.

For cases where no contribution data is shown, or you are seeking information about a specific development contribution matter, including payment receipts, please email Council at contributions@cityofparramatta.nsw.gov.au or contact the Council’s Customer Service Team on 1300 617 058 to confirm your Application number and the indexed contribution amount.

-

Accredited private certifiers have the same obligations as the Council when issuing Complying Development Certificates.

Private certifiers are required to impose a condition of consent to pay contributions and ensure that contributions have been paid.

Contributions Register

(Back to top)Council maintains a Development Contributions Register (for updated contribution figures please use the Live Contributions Fees Register) in accordance with Section 217 of the Environmental Planning & Assessment Regulation 2021. Due to volume, the information provided is limited to 5 years worth of development application and complying development approvals. Should you require information about older applications, please email your enquiry to Contributions@cityofparramatta.nsw.gov.au.

DISCLAIMER: While every effort is made to provide accurate information within the development contributions register it is noted that some errors or misdescriptions may occur. As such, this information should not be solely relied upon. If you are seeking information about a specific development contribution matter, please email your enquiry to Contributions@cityofparramatta.nsw.gov.au.

Planning Agreements

(Back to top)Planning Agreements are a voluntary legal agreement entered into between Council and a developer in conjunction with Council's consideration of a:

- Planning Proposal (rezoning application)

- Development Application; or

- Complying Development Certificate

Where the developer agrees to dedicate land free of cost, pay a monetary contribution, or provide any other material benefit such as transport or other infrastructure, public amenities or services, affordable housing or improvements to the natural environment, to be used for or applied towards a public purpose.

Planning Agreements can either be in lieu of or in addition to a development contribution payment, and this will form part of the negotiation.

Any land to be dedicated to the Council and public as a part of a Planning Agreement must consider Council's Land Dedication Policy, which aims to ensure that only suitable land is dedicated to Council, that will provide quality infrastructure, cost effective maintenance, opportunities, and services to meet diverse community needs and expectations.

Council has adopted the Parramatta Voluntary Planning Agreements Policy and Parramatta Land Dedication Policy.

Please refer to these policies when considering entering into a planning agreement with the City of Parramatta.

Planning Agreements Register

(Back to top)Council maintains a Planning Agreements Register in accordance with Section 206 of the Environmental Planning & Assessment Regulation 2021. This can be viewed as an interactive spatial map, or alternatively a pdf list.

DISCLAIMER: While every effort is made to provide accurate information within the planning agreements register it is noted that some errors or misdescriptions may occur. As such, this information should not be solely relied upon. If you are seeking information about a specific development contribution matter, please email your enquiry to planningagreements@cityofparramatta.nsw.gov.au

Making a VPA Offer

(Back to top)If you wish to make an offer to Council to enter into a Planning Agreement the offer should be made using Council’s letter of offer template.

Council has also prepared template documents for the draft legal agreement and explanatory note which must be prepared as part of the Planning Agreement process and which should be reviewed before you make any offer to Council.